Every morning, at 5:45 a.m. when your alarm clock goes off, the day begins and the daily obstacle of avoiding the landmine of potentially devastating and catastrophic events across your growing number of jobsites has begun once again. At any moment, a slip, a fall, an ‘oops’, an ‘uh-oh’, could result in a downpour of legal and fiscal decimation for you both personally with accounts being drained by funding your litigation while your business assets face seizure and liquidation since the insurance carrier found a loophole in your contractors general liability insurance policy. Don’t be ‘that’ guy, or gal.

Contractors build it once, yet have to sit back for years in fear of getting sued from one issue on one job. The statistics of having no issues are clearly weighted against the contractor.

Think of all the parties involved in a project: developers, investors, lenders, insurance carriers, architects, engineers, consultants, subcontractors, suppliers and manufacturers. If any one of them gets sued, they all get sued.

Lawyers, lawyers, and more lawyers.

Depositions, mediations, arbitrations and court trials – all taking you away from your current projects, costing you tons of money and lost opportunities. This affects your family life, your health, and most significantly, keeping you up at night wondering how you are going to get out of it.

This is a contractor’s biggest fear. But it doesn’t have to be that way. You can hedge your bet. You can limit your exposure. You can pull some or most of your chips off the table and insulate yourself from the claims, lawsuits and damages, or at the very least minimize your risk, by taking proactive steps to protect your assets.

Data reported by ABC from the U.S. Census Bureau marks the steady trend in increased construction spending from mid-2015 through mid-2020. This continual growth is likely consistent with your business, growing bigger each year while acquiring more and more liability exposure along the way.

Let’s discuss the types of risks that you as a general contractor face and how you together with Sollertis can protect assets from these risks.

THE RISKS

1. Construction Defect Claims

Construction defect claims are the most expensive and time consuming claims that a contractor will encounter. Again, if one party involved gets sued, everyone gets sued.

An attorney who once worked for me for many years in the past, went on to become a partner in a large construction defense law firm, and he would tell me stories about how many lawyers were involved in each deposition of a construction defect case. The parties typically include the developers, investors, lenders, insurance carriers, architects, engineers, consultants, subcontractors, suppliers, manufacturers and ultimate owners of the project or property.

Often times there are many subcontractors and it would not be unusual to see 10-30 parties involved in a construction defect lawsuit, with many of them cross-suing each other.

These are the claims that will cause you the most sleepless nights.

While sometimes the issues will manifest during or shortly after the completion of a project, often times they do not arise until many years thereafter. At Sollertis, I personally know of developers and contractors who had long retired yet still worried that something was going to come back from the past and bite them.

I’ll share the story of one particular general contractor who was the most meticulous when it came to managing his business, his project managers, and his subcontractors. His contracts were always dialed in tight and he was very diligent about doing change orders. He has the very best trained employees at customer service and used consultants and trade organizations to stay abreast of all issues facing his industry. Despite these efforts, he still had a claim or two every three years or so. Fortunately for him, he implemented an asset protection plan so he is sleeping sound at night knowing his nest egg is protected for him and his loved ones.

2. Contract Drafting Issues, Contract Management, and Processing and Accepting Change Orders

Issues arising from contracts and change orders are probably the most common type of claim brought against a contractor. These claims often come in the form of a bond claim, contract claim or mechanical lien. In each situation, the contracts involved will be at issue.

Someone is claiming that someone else didn’t do what they were supposed to do under the terms of the contract. Sometimes the claim will be that the agreed work was not done timely, or was not done in accordance with the plans or specifications, or it wasn’t done in accordance with the code. Other times, the claim could state the safety regulations or procedures were not followed.

The list of potential claims is seemingly endless.

I was once involved with a general contractor based in Southern California, who accepted a very lucrative construction project. It was a very big project for him and a lot of money was involved and he was, of course, excited about the opportunity and how the profits would help his business and his family financially.

After the contract was signed, he had the team begin work on the project. Soon after, a lot of unexpected circumstances arose on the jobsite.

This resulted in many phone calls, text messages and emails flying between the developer, my client, and all the contractors involved. He tried really hard to keep up with all the communications and changes to scope, but with all the extra work that he was being asked to do, he did not have the extra manpower to complete the extra work in the time that the developer wanted it done.

The extra work was causing massive delays as not only was there not enough manpower, but it also took time to get the extra materials and supplies. The developer was very demanding and all the contractors and subcontractors on the job spent every minute they possibly could trying to get the project to the finish line as fast as possible, often having crews work around the clock 7 long days a week.

The contract called for regular payments to be made by the developer and it was only a matter of time before the developer started complaining about the high cost of the project and the amount of time it was taking to get the project completed. This ultimately led to the developer refusing to pay any more money until the project was completed.

The general contractor agreed to stay on the job with the expectation that the two would be able to work things out together. After 3 more weeks of working without getting paid, though, the contractor had no choice but to walk off the job.

Can you guess what happens next?

The developer files claims against the general contractor, and involves all subs, suppliers, and anyone else attached to the unfinished project. Unfortunately, for the general contractor, although he had a signed written contract, he did a poor job of getting signed change orders and so did the subcontractors.

It was a huge mess and everyone has a different version of what happened. There are thousands of emails and text messages that the lawyers will need to go through as the parties squabble for years over who owes who money.

While this project turned really bad for this general contractor, there is one saving grace – his assets, including his house, are owned by an asset protection trust so he does not have to worry about losing them.

3. OSHA Issues, Dangerous Activity

Let’s face it, construction work is downright dangerous. One case I handled involved a guy who fell from the second floor because the structure on which he was standing gave way. He landed on the concrete on the floor below. This guy was built like a Navy SEAL and was otherwise okay, except for the fact there was rebar sticking up and out of the concrete that was not capped.

The rebar went through the back of his leg and came out the front.

They had to cut the rebar off just above the concrete, while he was sitting there with the rebar going through his leg, so they could transport him to the emergency room where they then removed the rebar.

This is just one of many construction job site injuries I could share with you, but if you are a contractor, you can tell me about many, many more. Once someone gets hurt, lawsuits get filed and often times lots of people on the job get sued. This will always be a risk if you are in this business.

4. Employment Issues

If you have a large labor force, this will be the risk that you encounter most frequently. I have represented contractors for years and there always seems to be one or more pending labor law claims that the company is paying lawyers to defend each and every month.

There are so many laws and regulations to protect employees, both at the federal and state level, and it’s extremely hard for even the most conscientious and fair employer to comply with all of the various levels and applications of the guidelines.

Then you have the wage and hour claims which often can turn into class action claims. Those are the big ones.

These claims are based upon an employee not getting his or her meal and rest breaks, and may include allegations of failure to pay the correct amount of overtime.

Let’s do the math. You have 100 employees and one of them claims that you did not comply with the law with respect to meal and rest breaks or overtime and therefore, every employee is owed $30 extra per day, multiplied by 260 working days per year, multiplied by 3 years and before you know it you have a $2.3 million in damages, and then, when they add in penalties and attorney fees, you suddenly are facing a $3-5 million dollar labor claim at your by-the-book company.

It takes just one disgruntled employee to start this process. You can be in business for years and years with no problems, but then you get that one letter demanding what you consider to be an exorbitant amount from a former employee who deserved to be terminated. You did nothing wrong so you reject his ridiculous demand and next you know his attorney has filed a class action lawsuit against your company.

You might have employment practices liability insurance, but that does not cover this type of claim.

As you can see, any one of these claims can cause restless nights and indigestion, to say the least. But it doesn’t have to be that bad. There are things you can do to minimize the risk and protect your assets in the event of personal exposure.

THE SOLUTION – 6 ASSET PROTECTION TOOLS FOR CONTRACTORS

All asset protection is going to start with a review of your business practices, existing entities and trusts, together with an inventory of all of your assets and liabilities, learning about the trusted advisors who are already on your team (CPAs, financial advisors, insurance brokers, attorneys, etc.), and understanding your family situation (spouse/children), retirement plans and dreams, and risk tolerance.

Once we complete this phase, we will want to develop a Master Asset Protection Plan, which is a comprehensive plan for the growth and protection of your wealth. For all clients this plan will include one or more asset protection trusts, limited partnerships and limited liability companies, and with particular attention spent determining the best jurisdictions in which to form these asset protection tools.

Asset protection is very custom to each person given each individual’s personal preferences and goals in growing their wealth safely, but there are some similarities between members of certain industries. With that said, let’s take a look at asset protection for general contractors and sub-contractors.

There are six basic tools that we typically deploy to protect contractors from the risks they face. These tools include building the wall, separating the business assets, factoring, capital contributions, cleaning up the documents, and retirement planning. Let’s take a look at each of these.

1. Build The Wall

This really is quite simple. Your construction, plumbing, HVAC, concrete, electrical, landscaping, sheet metal, solar, or pool installation company generates profits. You take those profits out of your company and you invest them.

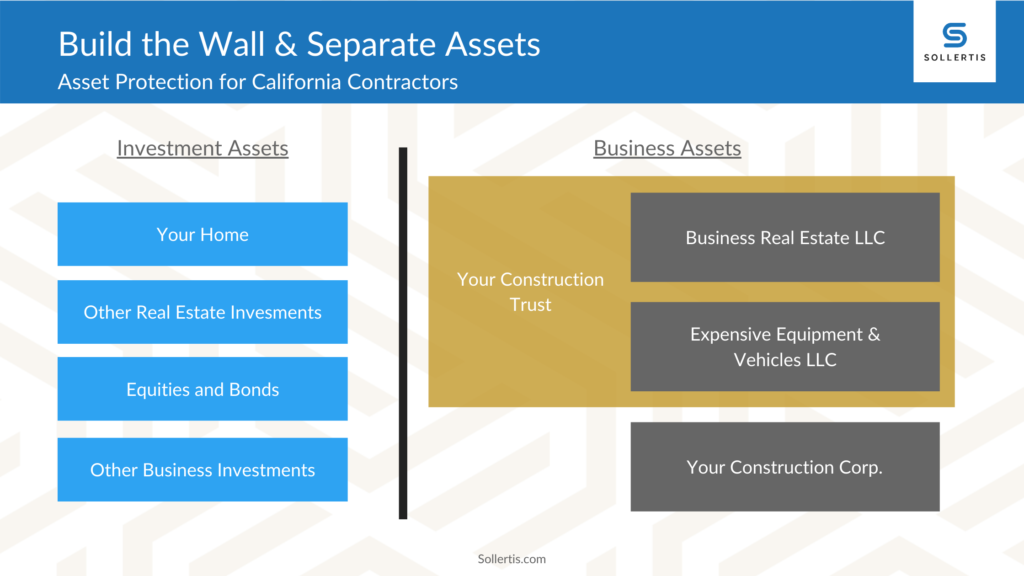

These investments typically include a residence, other investment real property, equities and bonds, and other business investments. We will refer to these investments as your Investment Assets.

We want to build a wall between your contracting business, where you face the most risk, and your Investment Assets. To do this, we use asset protection trusts and entities. With the wall in place, your Investment Assets are protected from the creditors of your contracting business.

2. Separate Business Assets

Let’s assume you have very expensive tools and equipment, plus heavy-duty horsepower trucks fully outfitted with bins and shelving, and a waterproof bed liner – the works, and you also own the real property of your shop or office building, i.e., the building and lots where you conduct your business, store your equipment, and accept deliveries from vendors.

Typically, all of these Business Assets are owned by your business, which is most likely a corporation, thus they are all exposed to the creditors of your business. To protect your Business Assets from these creditors, we want to LEGALLY separate them from your business.

We start this process by putting the business real property into a separate LLC, which will then lease that real property to your contracting corporation. We then want to put the expensive equipment and vehicles into a separate LLC, which will then lease the equipment and vehicles to your contracting corporation. And who owns these two new LLCs? You got it – a trust or entity that you own, that is ON THE OTHER SIDE OF THE WALL!

Another great benefit about separating Business Assets is that your CPA will have more tools available to reduce your income tax.

3. Factoring

Many contractors are owed a lot of money, otherwise referred to as Accounts Receivable or AR. As long as your contracting corporation owns your Accounts Receivables, it’s there and available for the taking by your creditors.

So, how do we get it out of there? Allow me to introduce you to the wonderful tool called “factoring.”

Factoring is a form of finance that is typically done for companies that are not strong enough to obtain a line of credit, or perhaps they have a line of credit but it’s not large enough to finance the level of growth the company is looking to achieve.

How does it work? Simple.

First, you sell a service or product and then invoice your customer. You now have an Account Receivable.

A factoring company then buys that invoice from you for a percentage of the total. For instance, if your invoice is for $10,000, the factoring company may give you $9,000 today. You get the instant cash and the factoring company gets the invoice to collect in the future.

Then, the factoring company collects the $10,000, in due time, from your customer.

So, how can factoring work for you? Easy.

Suppose you have Accounts Receivable totaling $1 million dollars. Taking the risk and timing in consideration for payment, the present day value of your AR may be approximately $900k.

So, a factoring company that you own then pays your contracting corporation $900k for your AR. Your corporation now has cash and pays it out to you and you put it where? That’s right – on the OTHER SIDE OF THE WALL.

And who owns the factoring company you ask? That’s right, a trust or entity that you own that is ON THE OTHER SIDE OF THE WALL.

And what if you don’t have the $1 million cash to purchase the Accounts Receivable from your corporation? No problem. We just purchase it a little at a time until it is all on the other side of the wall, and then we set up a system for purchasing it on a forward going basis as it is invoiced.

For instance, your factoring company can purchase just $100,000 of your corporation’s AR, your practice can then distribute that $100,000 to you, you can then invest those funds in your factoring company and then we can repeat the process over and over until all of your AR has been purchased.

4. Capital Contributions

Contractors frequently contribute large amounts of capital to their contracting corporations. Once you put this money in the corporation, it’s subject to the claims of the creditors of the corporation.

But what if your corporation were to borrow money from a lender? Wouldn’t that lender have a promissory note and demand that you pledge the assets of your corporation as security for that note? The lenders do this because then they are assured that if your business gets into financial trouble they will get paid first, before all other creditors.

In lieu of making large capital contributions to your contracting corporation, we would like you to loan the funds to your corporation, in other words, we want you to become the lender.

To do this, we will want to create a trust or LLC that will be the lender, a trust or entity that you own that is ON THE OTHER SIDE OF THE WALL.

This will ensure that if things go bad, you can get your money out first, before the other creditors.

5. Cleaning Up The Docs

While each of the above tools is meant to minimize the loss should a large claim arise, we also want to get inside your business and clean things up beginning at the ground level to minimize the risk of claims even arising.

First, we want to look at your contracts and change orders and help you develop a bulletproof system for doing business that will give you the leverage in the event of a contract claim.

Next, we want to review your employment practices, policies and contracts and help you tighten them up so we can minimize the risk of labor law claims.

These are the two most frequent types of claims and cleaning up your documents will go a long way towards minimizing the frequency and risk of claims.

6. Retirement Planning

In the State of California, certain assets have been mandated as exempt from attachment by your creditors and when we use these exemptions to protect our clients’ assets we refer to this as exemption planning.

The most common type of asset that we use for exemption planning is retirement plans. You may already have a retirement plan in place for you and your employees, but it will probably be too expensive to use this plan to protect your assets.

What you probably don’t know, is that you can create a private retirement plan under CA law that does not require you to allow your employees to participate.

With a private retirement plan you can protect much more of your wealth, but the rules are complex and there are certainly situations in which retirement plans will not protect your assets.

In fact, a case was just handed down last year where a business owner’s retirement plan assets were ruled not to be fully protected from his creditors. So, it’s important that you have your plan created by legal counsel to ensure it covers all that you have that needs protecting.

NOW YOU KNOW

There are many asset protection tools available to contractors. Remember, asset protection is like insurance, it doesn’t work unless you have it in place BEFORE THE CLAIM. So, don’t wait until it is too late to do this. You have been working very hard for many, many years to build your wealth. Pull your winnings off the table by protecting them now.

Take the first step today, and reach out to the experts in asset protection law at Sollertis.com.

This material has been prepared by Sollertis for informational purposes only and nothing herein is intended as legal advice for any particular or individual situation. You should not rely upon any information herein as a source of legal advice, and receipt of any such information does not create an attorney-client relationship between you and Sollertis. Viewers and readers should not act upon this information without seeking professional legal counsel. Prior results do not guarantee a similar outcome.