Strengthen Your Master Asset Protection Plan (MAPP®) with a Bridge Trust®

At Sollertis, we believe that without asset protection, you will never achieve true financial freedom. There is no one-size-fits-all solution to asset protection, so we customize a solution that’s right for you.

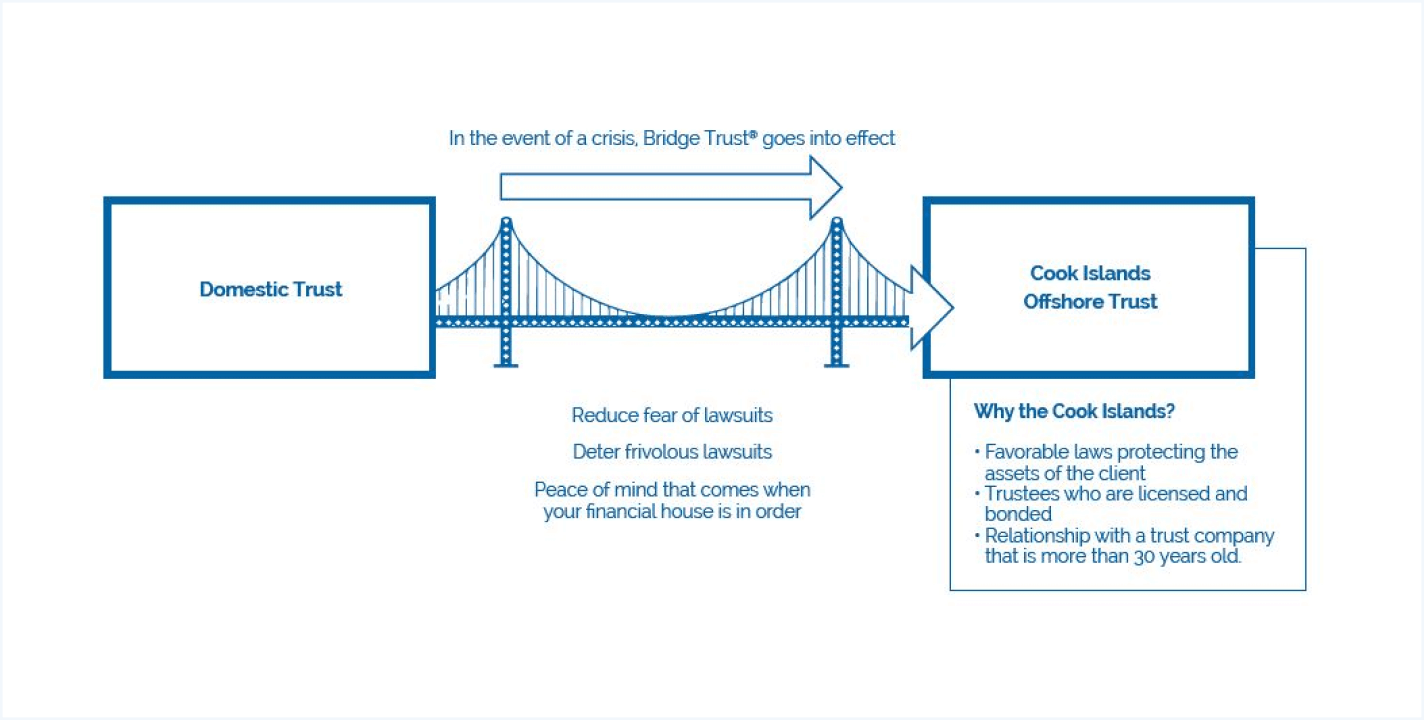

Domestic Trust

Domestic trusts provide a layer of protection to safeguard your assets, but that protection is limited.

As long as your plan remains fully domestic, your assets will still be subject to judgments and orders from U.S. courts.

Offshore Trusts

Offshore trusts in jurisdictions with established laws that prohibit trustees from recognizing foreign court judgments and orders are appealing, but this strategy comes with costs. To be legally binding, you must relinquish complete control of the assets you place in the offshore trust to a third party in a foreign country. While this is appropriate when actually defending a trust, it can be costly and compliance can be burdensome if done too early.

Bridge Trusts: Combining the Best of Domestic Trusts and Offshore Trusts

How do Bridge Trusts work?

Offshore Asset Protection Expert.®

Sollertis has a long-standing strategic partnership with one of the most experienced and respected legal experts in offshore asset protection planning to make sure the asset protection structures are built correctly and legally.

Long Standing Trustee Relationships.®

Through this strong partnership, we have established relationships with trustees in the Cook Islands and banks in Europe who have worked with US-based clients over the last 20 years.

Full Integration with Your MAPP.®

The Bridge Trust integrates seamlessly with the Sollertis Master Asset Protection Plan (MAPP), creating a totally integrated solution for you.

Get the Sollertis Summary

If you want timely asset protection news and practical ways to safeguard your wealth, submit your email address to receive a weekly email from Chief Counsel and Sollertis Founder.