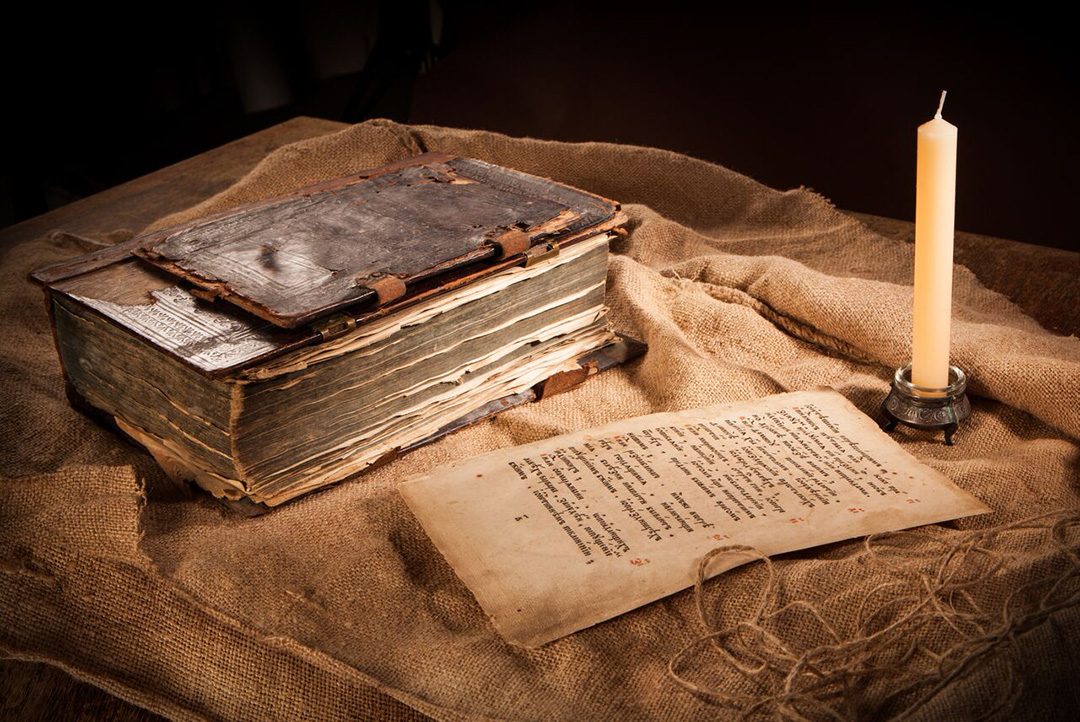

As a specific legal field, “asset protection” has only been around for a relatively short period of time. However, its origins date back to ancient times. Tracing its roots allows us to see the big picture and understand how this important practice area developed. Here are some important events in the history of asset protection.

200 B.C. – First mention of the ancient Roman institution of “fideicommissum” (meaning to commit something to one’s trust), a sophisticated system developed for leaving property to one’s heirs after death (testamentary trusts).

1200-1300 – Trust law starts to develop in England. When landowners left for the Crusades, they would transfer ownership to another party for upkeep in their absence. Upon their return, it often fell to the Court of Chancery to force the “trustee” to return ownership of the land to the “beneficiary.” This helped lead to the concept of the “inter vivos” or “living” trust, a major contribution of English common law.

1664 – Luke Barber, a doctor in colonial Maryland, tries to protect his assets from creditors by transferring them into trusts. He was unsuccessful, as the transfers were considered fraudulent conveyances.

1700’s – Thomas Jefferson engages in asset protection for the benefit of his daughter. He leaves property to her in the form of a testamentary trust designed to protect her inheritance from the creditors of his insolvent son-in-law.

1800’s – The concept of the spendthrift clause begins to develop in American trust law. At this time, they were nearly always considered invalid if the trust was self-settled (still the majority view in the U.S.).

1977 – Wyoming becomes the first state to allow for the creation of a new kind of business entity: the limited liability company (LLC).

1980’s – Although the limited partnership structure has been used for centuries, it becomes popular during this time among real estate investment groups. Eventually, attorneys start to notice and utilize its asset protection benefits as well.

1984 – The Cook Islands passes its International Trusts Act. Amended in 1989 with many favorable provisions, it makes the Cook Islands the first country to authorize the creation of international asset protection trusts. Several other countries would soon follow suit with similar legislation.

1997 – Alaska passes legislation authorizing the creation of the first domestic asset protection trust (self-settled spendthrift trust). Eventually, many other states join Alaska in allowing for the creation of SSST’s.

2011-2015 – A series of important court cases are decided showing the vulnerability of domestic asset protection trusts when used alone.

As you can see, “asset protection” as a field of law has only been around for the last few decades. (It’s no coincidence that this development has happened in the same timeframe as the litigation boom in the U.S. As our affinity for lawsuits has grown, so too has the need for asset protection.) Looking back at the historical context is a good way to understand how we got where we are, and where we might be headed.

Sollertis can help with asset protection

The Sollertis Master Asset Protection Plan™ is the framework for protecting all of the individual assets that contribute to financial success. Based on an analysis of your needs, each plan is a customized blueprint outlining the types and mix of legal structures needed to best meet your specific goals and objectives.

Once a MAPP™ is designed, you have a plan in place to protect your assets and to guide business, personal and investment decisions. Unlike traditional asset protection plans that take a “one-size-fits-all” approach, a MAPP™ adapts to changing circumstances. Whether implemented all at once or over time, you will create greater financial freedom knowing you’ve legally protected the wealth you have earned.

Contact us today to learn more about the Sollertis MAPP™ and our unique approach to managing all of your legal needs.

This material has been prepared by Sollertis for informational purposes only and nothing herein is intended as legal advice for any particular or individual situation. You should not rely upon any information herein as a source of legal advice, and receipt of any such information does not create an attorney-client relationship between you and Sollertis. Viewers and readers should not act upon this information without seeking professional legal counsel. Prior results do not guarantee a similar outcome.