Surgeons have a difficult task – If you want to practice medicine, operate, and help people you must simultaneously assume extreme risk and put yourself at exposure to both personal liability and professional liability.

It’s common knowledge that any medical procedure is risky for patients, but the less addressed concern is the equal yet different risk for the medical professional.

According to the American Medical Association, recent studies show 1 in 3 physicians have been sued, and by the age of 55, that number jumps to 1 in every 2 being hit with a lawsuit. Certain specialties such as obstetrician-gynecologists and surgeons are among those at higher risk of becoming defendants in a lawsuit, reaching risk as great as 4 times higher than their medical colleagues.

The diagnosis is clear and the prescription is legible.

You’re currently at risk, and immediate asset protection is the course of treatment.

RISKS THAT SURGEONS FACE

Surgeons need to protect their assets from the many risks they face as a manner of providing ordinary services and performing routine procedures. Let’s weigh some of those risks and review protection methods to defend and protect assets against medical liability lawsuits from patients.

1. Claims for Medical Malpractice

Let’s start with medical malpractice, a risk every surgeon faces. Sure, insurance is available and in California there remains a $250,000 cap on general damages. As we’ve experienced before, insurance companies can always reserve their rights and if they’re able to find any reason to deny coverage, they will.

The insurance company’s reason to deny coverage could stem from an untimely premium payment, inaccuracies in the application you submitted years ago which do not match your area of specialty today, or any number of other inconsistencies or legal reasons to avoid accepting liability and providing you with coverage. In those instances, you can expect to be on your own and without the protection of your insurance carrier.

As for the $250,000 cap on general damages for medical malpractice in California, there is a huge body of lawyers and politicians that have been trying for decades to overturn that law. The law providing the cap on general damages presently does not exist in the vast majority of other states. This movement is gaining more and more momentum, so it’s probably just a matter of time before California removes the cap.

Did you consider what happens once an insurance claim has been paid? Good luck getting your carrier or any other carrier to bite a second time and underwrite coverage for you, your professional group, or your surgery center.

2. Inadvertent Billing Fraud (and Doctors facing Criminal Charges)

The team at Sollertis has seen several incidents of billing fraud, another risk surgeons face. Insurance billing is so very complex and technical and it can be extremely challenging to comply with all of the rules and codes. I don’t know of any surgeons who handle their own billing. It’s typically handled by staff or an outsourced medical billing or surgical billing services company.

When billing mistakes are made, the surgeon is ultimately who faces the consequences, both monetarily and with State licensure.

A little over a year ago, I had someone in my office who was facing a criminal investigation for billing fraud made by a former employee whom he had hired to handle billing for his medical practice. He had a thriving and growing practice and was very focused on patient care and the execution of his system by all of his team members. He considered several employment candidates for his billing manager position, and ultimately hired someone with many years of experience. He was confident he had made the right choice and relied upon his new employee, who had much greater experience than him, to handle the practice’s insurance and Medicare billing.

For a few years, everything went great but then this billing manager asked for a raise based upon “all the money” she had collected and the “increased revenues” of the practice. That was the beginning of the end for this doctor.

After he uncovered the facts, he learned that the billing manager had been fraudulently billing insurance to increase his revenues so she could then justify her request for a pay raise. When he didn’t reward her fraudulent conduct, she reported him to the authorities.

Guess who was the primary witness against the surgeon? That’s right, the billing person herself.

She said, “the doctor told me to do it this way.”

Of course, she did. They want the principal, not the agent.

3. Federal, State, and Class Action Claims for False Advertising

Another risk that surgeons face is false advertising. Advertising executives are skilled at marketing, not compliance with the laws that regulate physician advertising. Surgeons are also not experts in the law and often times delegate responsibility for advertising and marketing to their management team, someone on staff, or an outside third party who are also not trained in the law.

False advertising is not always intentional. According to NORCAL, a national medical malpractice insurance company, physicians can run afoul of the laws and regulations in a variety of ways including:

- advertising discounted or free services

- misrepresenting their credentials

- using before-and-after photographs

- using celebrity testimonials or endorsements

- stating the effectiveness, safety or painlessness of treatment

Attorney Steven M. Harris, a nationally recognized health care attorney and a member of the law firm McDonald Hopkins, LLC, in his December 1, 2010 article in ENTtoday titled Advertise with Caution: State laws restrict how physicians can market themselves, he writes:

“In the event that your advertisement is found to be false, deceptive or misleading, you may be sued by the Federal Trade Commission (FTC) for disseminating such an advertisement to the public. Further, the FTC may fine you and enjoin you from disseminating the advertisement in the future. Perhaps most detrimental in this situation are the enforcement powers of the applicable state medical board, which could sanction you for inappropriate advertising as promulgated by the relevant medical practice act. Such sanctions could include fines, probation and, in egregious cases, suspension of your license. …”

In addition to FTC or state actions, false advertising can be the basis of a civil lawsuit, or combined with a medical malpractice claim. We’ve seen instances in which former patients have claimed that they would not have gone forward with the procedure had they not been fraudulently induced by the misleading advertisement of the doctor.

Not only will a fraudulent advertising claim complicate the medical malpractice defense, but also false advertising is not covered by the medical malpractice insurance policy. Knowing this, a savvy plaintiff’s lawyer could use a false advertising claim to certify a class action by all patients of a surgeon to recover fees paid by those patients to the surgeon.

There are so many seemingly harmless or inadvertent activities that occur each and every day in a surgeon’s practice that can result in litigation and liability. Surgery is a very dangerous activity, so dangerous that your typical consent form advises patients that they could die during the surgery!

With the chances of getting sued so high and the gravity of damages so great, and with all of the time and expense you put into getting to where you are in life, it would behoove you to take these risks very seriously and be proactive to protect yourself.

So how do you protect your assets from these risks?

ASSET PROTECTION FOR SURGEONS

All asset protection is going to start with a review of your business practices, existing entities and trusts, an inventory of all of your assets and liabilities, learning about the trusted advisors who are already on your team, meaning your CPAs, financial advisors, insurance brokers, attorneys, whomever – and understanding your family situation (spouse/children), retirement plans and dreams, and risk tolerance.

Once we pass this phase, we’ll want to develop your Master Asset Protection Plan, which is a comprehensive framework for the growth and protection of your wealth. The plan is customized to fit your specific situation in all parts of life.

For all clients, the plan includes one or more asset protection trusts, limited partnerships and limited liability companies, with particular attention spent determining the best jurisdictions in which to form these asset protection tools.

Asset protection is very unique to each person, but there are some similarities between members of certain industries. For instance, manufacturers have very similar risks that they face as do transportation companies, general contractors and so many others. With that said, let’s take a look at asset protection for surgeons.

There are four basic tools that we typically deploy to protect surgeons from the risks they face. These tools include building the wall, separating the business assets, factoring, and retirement planning. Let’s take a look at each of these.

1. Build The Wall

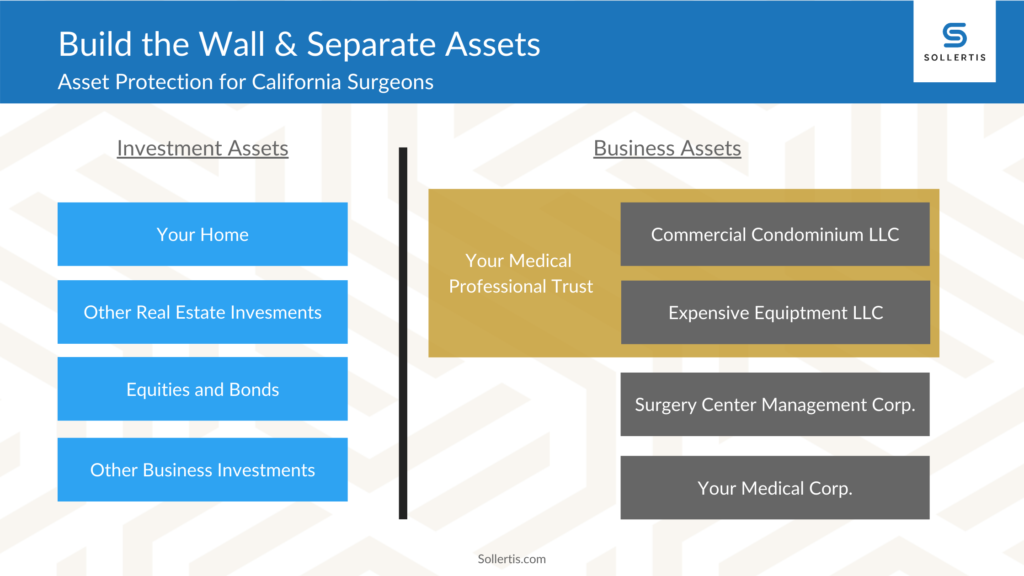

This really is quite simple. Your practice generates profits. You take the profits out of your practice and you invest them. These investments typically include a residence, other real estate investments, equities and bonds, and other business investments. We will refer to these investments as your Investment Assets.

We want to build a wall between your medical practice, where you face the most risk, and your Investment Assets. To do this, we use asset protection trusts and entities. With the wall in place, your Investment Assets are protected from the creditors of your practice.

2. Separate Business Assets

Suppose you have an ownership or partnership interest in a surgery center where you perform your surgeries. Suppose that surgery center is housed in a commercial condominium or other real property that you own and that there is expensive medical equipment, owned by you, used both in that surgery center and your medical office.

Typically, all of these Business Assets are owned by your medical corporation, thus they are all exposed to the creditors of your practice. To protect your Business Assets from these creditors, we want to create a separate corporation that will operate the surgery center.

We then want to put the commercial condominium into a separate LLC which will then lease the condo to the surgery center corporation, and we want to put the equipment into a separate LLC which will then lease the equipment to both the surgery center corporation and your medical corporation.

Wondering who owns these two new LLCs? You guessed it… a trust or entity that you own that is ON THE OTHER SIDE OF THE WALL!

Another great benefit from separating Business Assets is that your CPA will have more tools available to reduce your income tax.

3. Factoring

Many surgeons are owed a lot of money, otherwise referred to as Accounts Receivable or AR. Surgeons that perform a lot of surgeries for personal injury victims typically accept a lien against the settlement, which means they get paid when the case resolves.

Now, the time to file a personal injury suit has been extended from 1 year to 2 years, and the courts are no longer “fast-tracking” these cases through the system due to budget deficits which results in these personal injury cases taking longer to resolve, and surgeons must wait longer to get paid. This translates into much higher Accounts Receivables accruing year after year.

We’ve helped surgeon-clients in the past that had millions of dollars in AR – one I can recall had more than $10 million. As long as your Accounts Receivable is owned by your medical corporation, it’s accessible and there for the taking by your creditors. So, how do we get this large asset out of your medical corporation? It’s my pleasure to introduce you to a wonderful tool called “factoring.”

Factoring is a form of finance that is typically done for companies that are not strong enough to obtain a line of credit, or perhaps they have a line of credit but it is not large enough to finance the level of growth the company is looking to accomplish.

How does it work? Simple. You first render a service or sell a product and then invoice your customer. You now have an Account Receivable. The factoring company then buys that invoice from you for a percentage of the total. For instance, if your invoice is for $10,000, the factoring company may give you $9,000. You get the instant cash and the factoring company gets the invoice. Your Accounts Receivable goes down by $10,000 and your cash (bank account) goes up by $9,000 and you take a $1,000 expense on your books (for the services of the factoring company). The factoring company then collects the $10,000, in due time, from your customer.

How can factoring work for you? Suppose you have an Accounts Receivable totaling $3 million, in personal injury liens or otherwise, and taking into account the risk and number of months it will take to collect payment into consideration; the present day value of your AR may be approximately $2 million.

So, a factoring company that you own then pays your medical practice $2 million for your AR. Your medical practice now has cash and pays it out to you and you put it where? That’s right … ON THE OTHER SIDE OF THE WALL.

And who owns the factoring company? That’s right, a trust or entity that you own that is ON THE OTHER SIDE OF THE WALL. This entire operation can easily be set up to ensure that millions of dollars in Accounts Receivable is protected from the creditors of your medical practice.

And what if you don’t have the $2 million cash to purchase the Accounts Receivable from your practice? No problem. We just purchase it a little at a time until it is all on the other side of the wall, and then we set up a system for purchasing it on a forward going basis as it is invoiced.

For instance, your factoring company can purchase just $100,000 of your practice’s AR, your practice can then distribute that $100,000 to you, you can then invest those funds in your factoring company and then we can repeat the process over and over until all of your AR has been purchased.

4. Retirement Planning

The State of California has certain assets that it has mandated are exempt from attachment (otherwise, untouchable) by your creditors and when we use these exemptions to protect your assets, we refer to this as exemption planning.

The most common type of asset that we use for exemption planning is retirement plans. Many surgeons already have a defined benefit or other retirement plan. What many do not know is that these plans are in fact protected from your creditors under state law. But the rules are complex and there are certainly situations in which retirement plans will not completely protect your assets.

Last year, a case was decided where a doctor’s retirement plan assets were ruled to be not protected from his creditors. So, it is important that you have your plan reviewed by legal counsel to ensure it is protected from all angles. Once establishing your plan is fully protected, you should consider contributing as much possible because these funds will not only be protected, but also a very good tax planning tool.

NOW YOU KNOW

As you can see, there are many asset protection tools available to surgeons. But remember, asset protection is like insurance, it doesn’t work unless you have it in place BEFORE THE CLAIM. Don’t fail to take action today when you can be proactive and afford yourself all of the benefits explained.

Waiting until after there’s a reason to protect your assets is waiting too long, and it’s then too late. You’ve been working very hard for many, many years to build your wealth. Pull your winnings off the table now and protect them while you still can, legally. Contact the asset protection law firm dedicated to serving surgeons and medical executives, Sollertis.

This material has been prepared by Sollertis for informational purposes only and nothing herein is intended as legal advice for any particular or individual situation. You should not rely upon any information herein as a source of legal advice, and receipt of any such information does not create an attorney-client relationship between you and Sollertis. Viewers and readers should not act upon this information without seeking professional legal counsel. Prior results do not guarantee a similar outcome.