True wealth is protected wealth. True happiness is having options with handling that protected wealth with layers of security, control, oversight, and checks and balances.

As we’ve recently witnessed, having options available with your finances and being able to take action on those decisions with speed is almost priceless in our global economy. Everyone is impacted and prevention is essential to the safety for you and the ones you care about.

For individuals in the US who or are leery of having foreign accounts or allowing foreign banking to be part of your asset protection planning strategies, domestic asset protection may not only be the conservative wealth protection approach you’ve been looking for, but also the best and most flexible long term asset protection available.

What most people ignore as they build wealth over the years, is the need to protect and structure their wealth wisely.

The Sollertis Slide Trust® is the ultimate domestic asset protection tool. Let’s discuss what it is and how it works.

WHAT IS THE SLIDE TRUST?

To understand how the Slide Trust can protect your assets, let’s first share some basics to provide content and a brief history of asset protection trusts.

Spendthrift Trust

A spendthrift is a person who spends improvidently or wastefully, or in short, a person who is prone to blowing their money.

Trusts were typically set up by parents for their children. The parents wanted to ensure that their children did not blow through the money, so they included a provision that gave the Trustee of the trust the power to hold a spendthrift child’s money in trust in lieu of giving the money to that child outright.

When a Trustee determined that a child was irresponsible with money, he would retain that spendthrift child’s funds in trust, using the money from time to time for the child’s benefit, for instance, sprinkling some cash to the child on a periodic basis, buying things for the child, or paying directly for expenses of the child.

Not surprisingly, the situation arose where the spendthrift child got into debt. The creditors of the child wanted to collect their money so they started suing the trust to force the Trustee to pay money to the child so they could get their money or in the alternative, to force the Trustee to pay money directly to them, the creditor. In order to prevent these lawsuits from being successful, attorneys started including a “spendthrift clause” in their trusts, a clause that prevented the creditors of a spendthrift child from being able to access that child’s funds which were in the trust. This was the first time that a trust was used to protect assets from a creditor.

Self-Settled Spendthrift Trusts (Before 1989)

As spendthrift clauses became a standard provision in trusts, it was only a matter of time before people attempted to block their own creditors from accessing the funds in their own trust while they were still alive. Unfortunately, these early attempts to use one’s own trust to protect one’s own assets did not succeed.

While every state in the United States recognized the right of a Settlor to protect assets put into trust for someone else’s benefit, no state in the United States recognized the right of a Settlor to protect assets put into trust for their own benefit, a self-settled trust. In fact, to prevent individuals from creating self-settled trusts to defeat their own creditors, the laws of most states provided that a spendthrift clause in a trust does not protect the Beneficiary to the extent that the Beneficiary is also the person who settled the trust.

The rationale behind these laws was that it is not reasonable for your creditor to expect to satisfy their claim against you from someone else’s assets, even someone who has put their assets in a trust for your benefit, but it is reasonable for your creditor to expect to satisfy their claim against you from your own assets, even if you have put them in a trust for your benefit.

So, to summarize, prior to 1989, if the assets are yours, your creditors can reach them, but if they were originally someone else’s assets and had been put into a spendthrift trust for your benefit, your creditors cannot reach them. This was the law until the Cook Islands amended its International Trust Act.

The Cook Islands (1989)

The Cook Islands is a self-governing island country in the South Pacific Ocean in free association with New Zealand. New Zealand is responsible for the Cook Islands’ defense and foreign affairs, but these responsibilities are exercised in consultation with the Cook Islands. Cook Islanders are citizens of New Zealand, but they also have the status of Cook Islands nationals.

Until the 1980’s, hardly anyone had even heard of the Cook Islands. Then, in an effort to boost their economy, they engaged some of America’s best trust attorneys to help them revise their trust law to attract American citizens, making them the first country to enact an explicit asset protection trust permitting, for the first time, a self-settled asset protection trust.

The trust laws of the Cook Islands strongly favor property rights over creditors and the courts of the Cook Islands are vigilant in their enforcement of their laws, in one instance denying a creditor so mighty as the United States Federal Trade Commission who attempted to recover assets from a Cook Islands trust. Not only was the FTC unsuccessful, but they were ordered to pay the legal fees of the Cook Islands Trustee.

The Cooks Islands asset protection trust law changed everything. Soon, Belize, Nevis, and other countries followed in the footsteps of the Cook Islands by enacting their own asset protection trust laws to compete for American asset protection trust business.

Domestic Asset Protection Trusts (1997)

Taking the lead from the offshore jurisdictions, and seizing the opportunity to “steal” some of their American asset protection trust business, in 1997 Alaska was the first state in the United States to enact asset protection legislation.

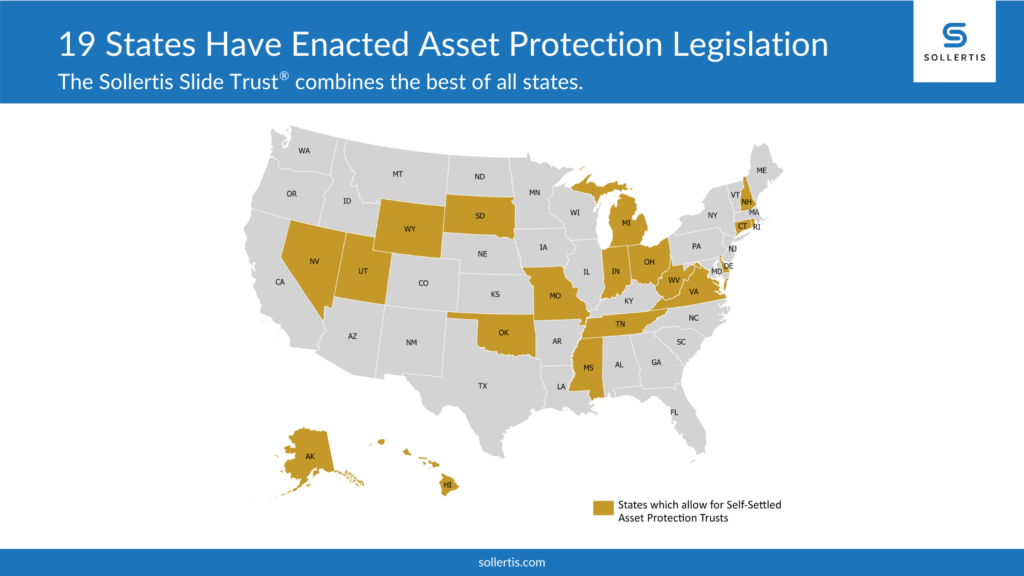

Including Alaska, nineteen states have now enacted legislation allowing for self-settled asset protection trusts. Those states are Alaska, Connecticut, Delaware, Hawaii, Indiana, Michigan, Mississippi, Missouri, Nevada, New Hampshire, Ohio, Oklahoma, Rhode Island, South Dakota, Tennessee, Utah, Virginia, West Virginia and Wyoming.

Offshore asset protection trusts provide the greatest level of protection, but they require you to engage an expensive offshore Trustee, participate in a rigorous due diligence process, maintain an offshore bank account, and report your offshore accounts to the IRS on complicated tax forms. All of this results in much more documentation, delay, and money. For these reasons, many clients tend to favor domestic asset protection trusts.

There is no uniform asset protection trust law, so each state’s legislation is different from each other state. In fact, each state regularly changes its asset protection laws to give it an advantage over the other states in the competition for your asset protection trust business. Because the asset protection trust laws are regularly changing, the best state for asset protection trusts changes from time to time.

There was a point when we liked Delaware the best, and then there was a time when we liked Nevada the best. Each of these states has recently had court decisions diminish the protection their laws offer, so they are no longer our preferred domestic jurisdiction.

One of the most important aspects of domestic asset protection law is whether the courts and law of the state in which the trust is formed will control, or whether the courts and law of the state where the Settlor resides will control. This is particularly important for California residents as California courts and laws do not favor asset protection.

For this reason, at this time, we like Wyoming the best for domestic asset protection trusts (commonly referred to as “DAPTs”). Not only have they shown a long term commitment to asset protection similar to the offshore jurisdictions, but they have updated their asset protection trust law several times in recent years to ensure that only the courts and laws of their state will control their asset protection trusts (which they refer to as a “Wyoming Spendthrift Trust”).

Of course, the laws could change at any time. What if you were to form an asset protection trust in Wyoming and thereafter the laws change making a different state a much better option for you? To solve this problem, we created the Slide Trust.

The Slide Trust (2020)

While Wyoming is currently the best state in which to protect assets of California residents, there is always a chance that the Wyoming legislature or a court in Wyoming could change or interpret one of its laws in a way that would negatively impact your rights. Likewise, other states are expected to enact new legislation, which may potentially make them a better jurisdiction for California residents to protect their assets.

“The Slide Trust combines the best of all states. It is a domestic asset protection trust that “slides” from state to state when you need it to.”

– William R. Simon, Jr., Founder and Chief Counsel at Sollertis

Now that you understand the history of asset protection trusts and know what the Slide Trust is, let’s discuss how we put this into action to protect assets for California residents, both in San Diego where our office is located and throughout the state.

HOW DOES THE SLIDE TRUST WORK?

Like all trusts, the Slide Trust has the following three components:

- Settlor: this is the person who creates or settles the trust. Sometimes the Settlor is referred to as the Grantor or Trustor.

- Trustee: this is the person who holds the trust property, under the written terms established by the Settlor in the trust document, for the benefit of the Beneficiary.

- Beneficiary: this is the person who benefits from the trust assets.

Typically, to settle a trust, the Settlor will execute a trust document, which names the Trustee and the Beneficiary, and will then transfer assets into the trust. Now, let’s discuss the specifics of the Slide Trust designed by Sollertis.

Sollertis is a leading law firm in asset protection using innovative and current strategies for California residents. The team at Sollertis is led by Chief Counsel William R. Simon, Jr., Esq. and offers the simplest and smartest way for business owners and wealthy individuals to address personal and business legal matters together with one cohesive personal and business legal team.

Self-Settled Asset Protection Trust

The Slide Trust is a self-settled asset protection trust. If you remember, a self-settled asset protection trust is a trust where the Settlor is also the Beneficiary.

In other words, the Settlor is putting his or her own assets into the trust for his or her own benefit and including a spendthrift clause stating that creditors cannot access the assets of the trust. To ensure your Slide Trust is recognized as a self-settled asset protection trust, it’s settled under the laws of one of the nineteen states that currently recognize self-settled asset protection trusts. At present, we like Wyoming the best.

Out-of-State Trustee and Lack of Control

For California residents, there’s a very good chance that a Creditor will sue you in California and will ask a California court to enforce California law requiring you to transfer assets in your domestic asset protection trust to your Creditor.

This is why the very first thing you need to know about your domestic asset protection trust is that it must have an out-of-state Trustee.

So, for example, if you are going to have a Wyoming asset protection trust, you need to have a Wyoming Trustee. The California court will not have jurisdiction over the Wyoming Trustee and will therefore not be able to order the Wyoming Trustee to do anything, let alone transfer trust property to your Creditor.

This will not stop the California court from attempting to help your creditor get to the assets of your domestic asset protection trust.

The California court will order you to instruct the Trustee of your trust to transfer the assets in your trust to your creditor. As a resident of California, you will have to do as the California court orders, or else you will be held in contempt of court for which you can be put in jail.

So, you will instruct your Trustee to transfer assets to your creditor. But wait – your domestic asset protection trust will not give you control over distributions of your trust assets, so the Trustee of your trust will disregard your instruction. Further, there will be a provision authorizing the Trustee to disregard any order coming from you under duress, i.e., under orders from a court. So, for both of these reasons, your Trustee will not transfer your assets to your Creditor.

By using an out-of-state Trustee, not giving you direct control over distributions of trust assets, and by including the duress clause, the Slide Trust wins the battle over the battleground as now your creditor has to go to Wyoming to fight the war, a state where the courts and laws favor asset protection.

Directed Trusts

Historically, Trustees handled the administrative functions of the trust and invested the trust assets. In recent times we have seen the development of the directed trust, a trust in which the Trustee handles the administrative functions of the trust, but you, or a group of people you select, handle the investment of the trust assets.

The Slide Trust is structured as a directed trust, so you have control over the investment of the trust assets. In exercising this control over the investment of the trust assets, however, you have the right to choose to delegate this responsibility to your Trustee.

Beneficiaries

Typically, you would name yourself, your spouse, and your lineal descendants (children, grandchildren, etc.) as the Beneficiaries or your Slide Trust. So, your Slide Trust will be a self-settled trust in that you are both the Settlor and a Beneficiary, but it will be sited in a state in which self-settled spendthrift trusts are recognized and enforceable.

Although you are a Beneficiary, neither you nor any other Beneficiary has the power to control distributions. This way you get to control the investment of the assets, but if you want to take money or assets out of the trust, which we refer to as a distribution, you will have to ask your Trustee to make a distribution to you or to one of the other Beneficiaries.

Your Trustee will do as you request unless you are asking for a distribution under the duress of a court order, in which event the Trustee will not do as you request. This is exactly what you want and is the mechanical component of the Slide Trust that provides protection of your assets.

Trust Protector

A trust protector is a person appointed to watch over the Trustee and whom has the power to remove and replace the Trustee if the Trustee is not doing what the Settlor intended them to do.

Typically, your Trust Protector will be your attorney or your attorney’s law firm. This is an additional safeguard in case your Trustee and you have a difference of opinion on a major issue, your attorney, acting as your Trust Protector, can remove your Trustee and appoint another person in their place.

The Slide Provision

This is the provision for which your Slide Trust was named. This provision provides that, if necessary to protect the assets in your trust, your Trust Protector can cause your trust to slide to any other state.

This means your Trustee would be removed and a new Trustee in the new jurisdiction selected by your Trust Protector (your attorney) would be appointed (only after discussion with you and your consent).

The importance of the Slide Provision is that the laws in the various states of the United States may change from time to time.

For this reason, you need to have the ability for your Slide Trust to slide from its current jurisdiction to a more favorable jurisdiction.

For example, right now we prefer Wyoming. But what if we help you settle a Slide Trust in Wyoming and then, 7 years from now, Wyoming enacts unfavorable legislation changing their asset protection laws? Without the Slide Provision you would be stuck in Wyoming with these new unfavorable laws. But with the Slide Provision you could simply slide your trust to another state.

NOW YOU KNOW

The Slide Trust by Sollertis is the most innovative and important domestic asset protection tool available to business owners. For those that do not feel comfortable going offshore, it is the perfect solution.

Now that you understand what the Slide Trust is and how it works, you should also be well informed in knowing that asset protection is like insurance, it doesn’t work unless you have it in place BEFORE THE CLAIM.

Failure to act and protect your assets can only cause devastation in the future if issues do arise. Don’t wait until it is too late to protect everything you have. Pull your winnings off the table by protecting them now with a Slide Trust.

The trust and asset protection law firm, Sollertis, is based in San Diego, California. Learn more about the options available for you and your family at Sollertis.com.

This material has been prepared by Sollertis for informational purposes only and nothing herein is intended as legal advice for any particular or individual situation. You should not rely upon any information herein as a source of legal advice, and receipt of any such information does not create an attorney-client relationship between you and Sollertis. Viewers and readers should not act upon this information without seeking professional legal counsel. Prior results do not guarantee a similar outcome.